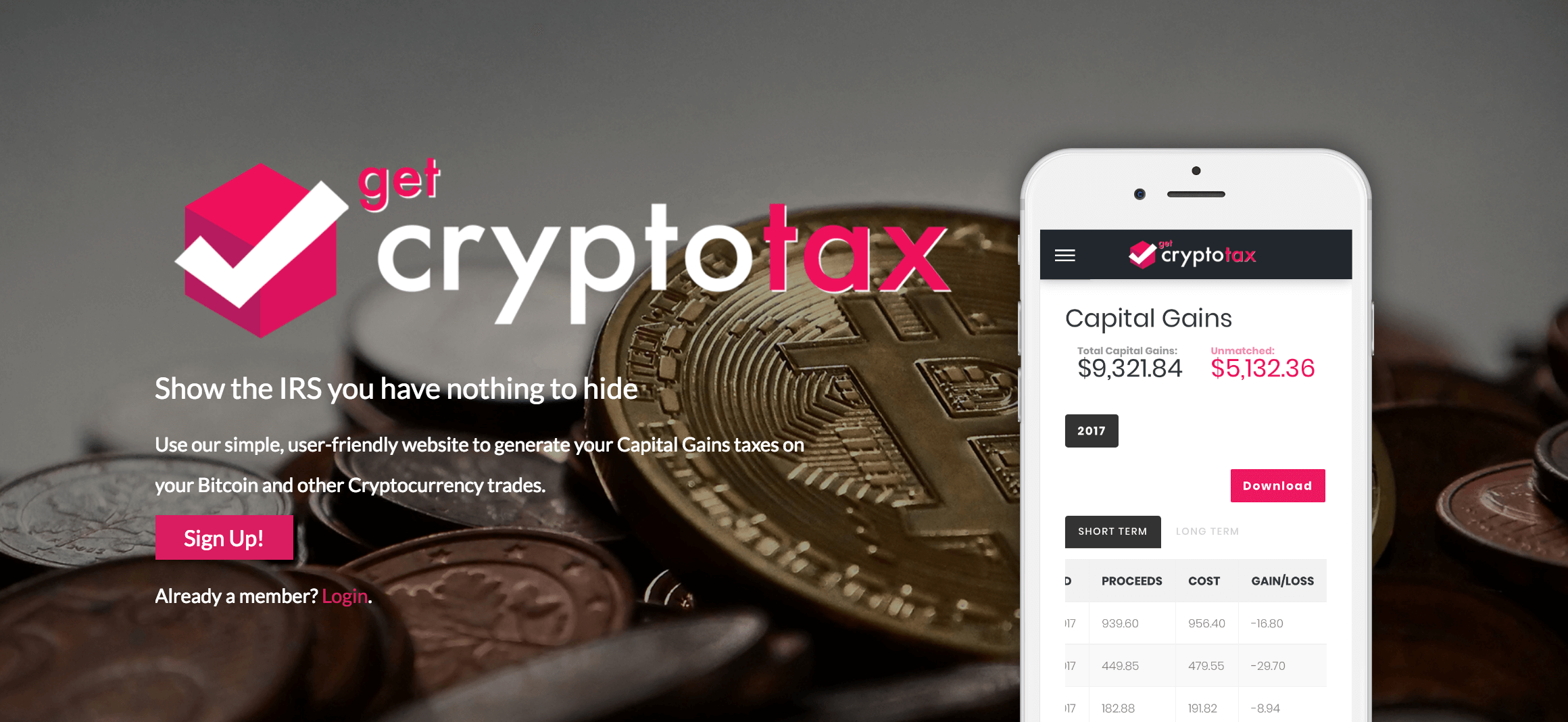

GetCryptoTax is the simple yet useful web app where you can file your Capital Gain taxes on the Bitcoin and other Cryptocurrency trades. Since, this web app asks for much information about your cryptocurrency wallets in order to know that what kind of trades you are making in the crypto market; it is essential to know about this web app in detail.

Bitcoin and other cryptocurrencies have seen a huge revolution in recent years and they are growing rapidly as the days are progressing. Since, the people are investing more on cryptocurrencies they are facing an issue of filing their income and the gains in capital. But fret not, getcryptotax is there for the rescue.

You might be thinking that the IRS will not know about your trades on the cryptocurrencies, but they know it well about your trades and they are monitoring on single trades. Also, they have an eye on the returns you file whether you are declaring the crypto assets or not.

Recently, getcryptotax launched their web product, which will help all the cryptocurrency traders to declare their capital gains in the form of bitcoins or other cryptocurrencies in the tax forms. The interesting fact is that the traders don’t even know that they have to show their cryptocurrency earnings. Tax filling websites doesn’t even ask if you have sold any cryptocurrency previous year and crypto exchange sites don’t even ask you for Form 1099. So, they have left it to the individuals to be at the top of the tax laws and declare the capital gains.

Now, you came to know that it is important to declare the crypto earnings. Do you know what the penalties are if you are caught by the IRS that you have not declared your capital gains? They will charge the additional 20% of the understatement of the tax in the form of “negligence or disregard of rules” or “substantial understatement” penalty. Also, if the IRS thinks that you have done it intentionally then they will charge the additional 75% of the understatement of the tax in the form of committing fraud.

Traders think that the Bitcoins are untraceable and they cannot be traced by the IRS. So, they thought of taking the leisure of not paying taxes for the bitcoins trades. But, IRS partnered with the Chainanalysis in 2015 and they are able to trace those traders.

How to file the crypto tax?

In US, cryptocurrencies are considered as the property by the IRS just like the stocks. So, it should be declared in the investments and the capital gains.

Use Getcryptotax.com

Getcryptotax is launched in 2018 with the prime focus of ensuring the users are compliant to all the tax laws related to the cryptocurrencies. This app is quite user friendly and simple to use. The features of the app are useful where it take you from step by step tutorial to pull the information about your crypto investments from exchanges. Then, you can import the data in the Excel and check for the investments made by you.

This app doesn’t support the API connection because if you don’t use it properly then it can trade the bitcoins with your money without your consent. So, it is safer to deal in the spreadsheet rather in the API connection. Since, the tax file sword is already on the head; go ahead and use the getcryptotax to declare the capital gains.

Conclusion

Now, you have understood that the IRS have their eyes on the bitcoins exchanges you have made in previous year, so it is clear that you must declare as the capital gain in the tax form. So, to avoid any last minute hassle getcryptotax is for the rescue and you can use this simple web application to save the time and save yourself from committing fraud.